Recommendation: Buy and hold for Make-Whole.

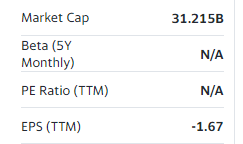

Right now, it seems like Twitter can’t possibly get more news coverage. Naturally, its equity is the hot topic being discussed in the world of merger arbitrage.

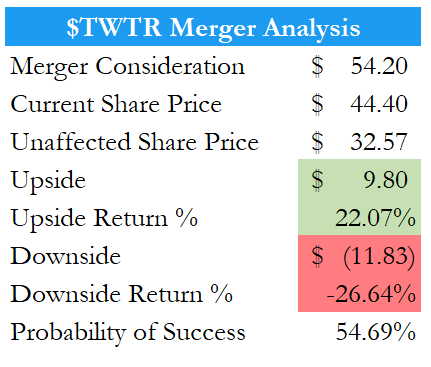

The stock is currently trading at about $44.40, a tick above halfway between the unaffected price (before Elon started buyng) and the implied purchase price if the deal were to go through – implying around a 50/50 chance of the deal closing. A simple analysis on the equity trade is below:

However, everyone seems to be forgetting about something: the bonds! They seem to be pricing in a much lower probability of the deal closing..

|

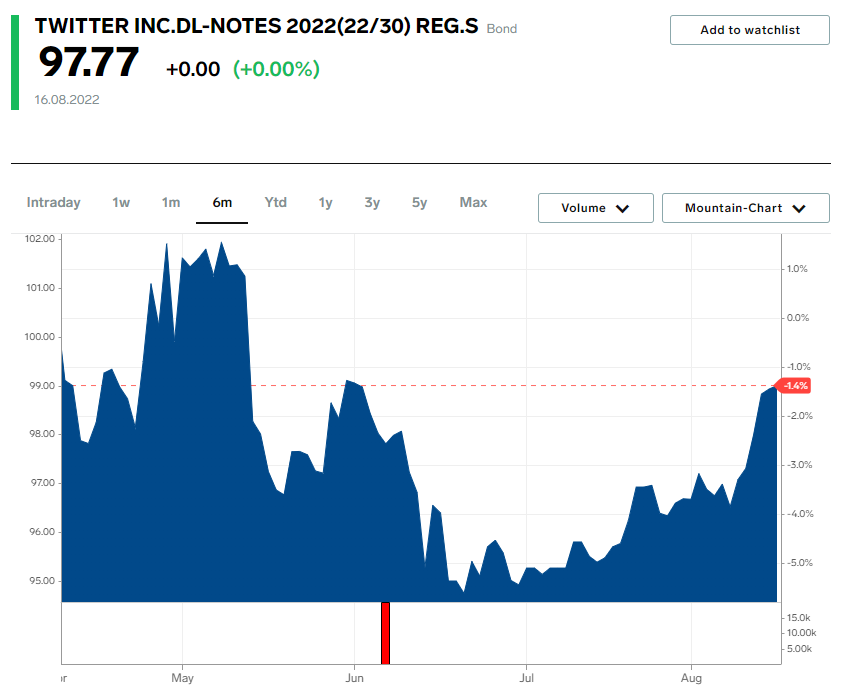

| Don't judge the Business Insider bond price chart. |

In early April, when Elon Musk had just filed 13D and right around the time of the offer, the bond traded just around par, ranging from 98-100. It touched the 101s in May as the deal was being put together, pricing in a near-certain Change in Control tender, but since Elon has announced his intention to terminate, the bond has dropped below even its “unaffected” levels. Even with the recent announcement of the judge ruling in Twitter’s favor for an expedited trial, it has not rebounded to its unaffected price. As this combined with the debt agreement provides a chance for upside with minimized downside within the trade, I believe the 5% 2030s offer an enticing investment opportunity.

The Trade

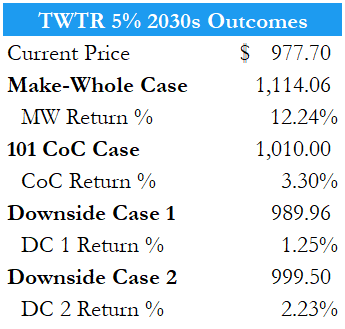

The concept of the trade is to buy the bonds and profit in the case of a forced close on the deal.

The existing 5% 2030 Senior Unsecured Notes are “non-call” meaning they cannot be “called”, or prematurely paid off, except for in specifically stated circumstances. If the court rules that Elon has to close the deal, the two “call” options are as follows:

The Change-Of-Control (CoC) Repurchase

The Make-Whole (MW) Optional Redemption

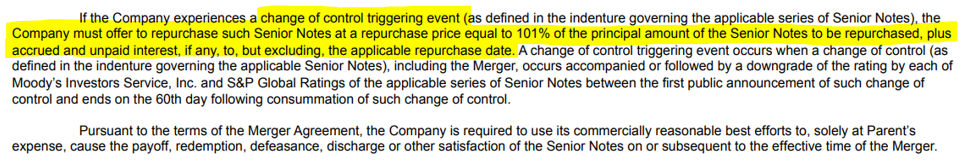

Change Of Control Repurchase

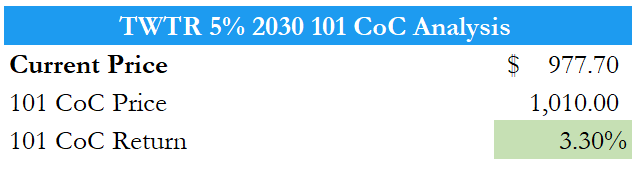

In the case of a “change of control triggering event” (in this case the sale to Elon), the Change of Control (CoC) repurchase offer must be extended by Twitter. The indenture lays out that the bondholder will have the option for the company to repurchase the bond from them at 101, give or take a few cents for interest. If a bondholder were to accept this tender offer, they would return as follows:

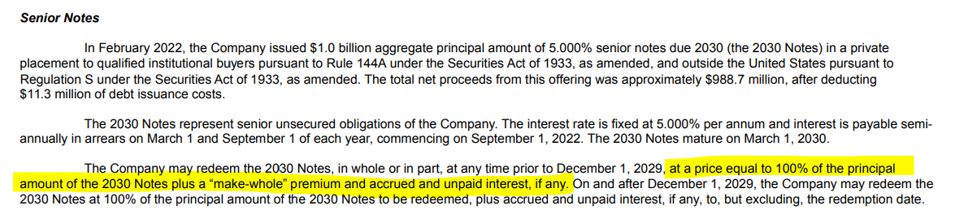

Make-Whole (MW) Premium Redemption

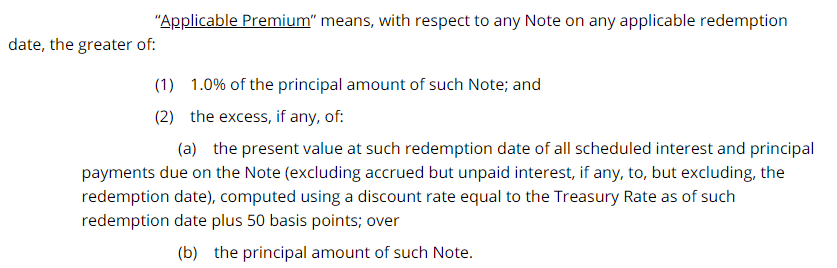

The other option in the bond for a premature call is a make-whole redemption. This optional redemption can be done “at a price equal to 100% of the principal amount”, “plus a make-whole premium and accrued and unpaid interest”. This “premium” is one of the following:

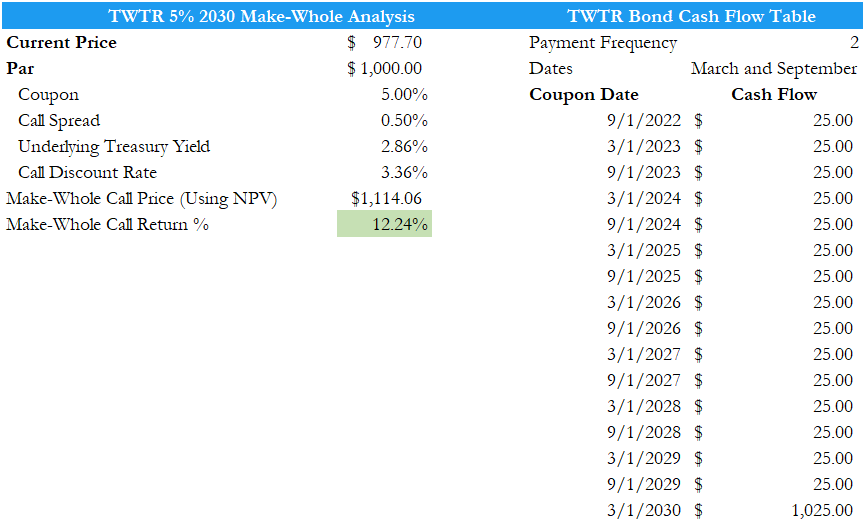

(2) is the greatest, and generates a return for bondholders calculated as follows:

Clearly, the make-whole offers a greater return for bondholders than the CoC. However, the make-whole can really only occur if the bondholder rejects (“holds out” on) the CoC offer.

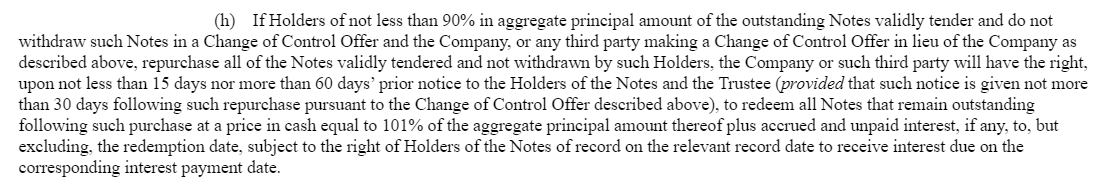

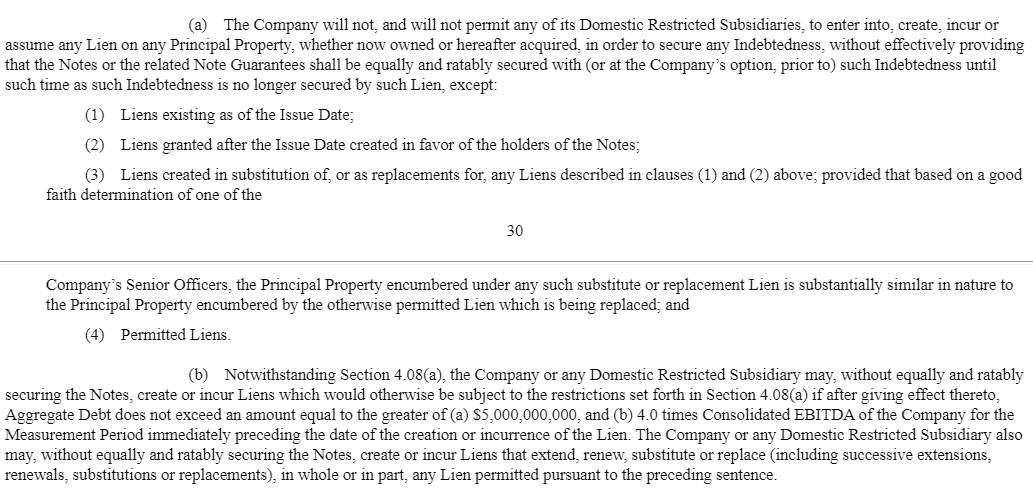

There is a restriction on sharing liens above the basket amount of $5B with these bonds, unless approved by the bondholders. The merger agreement includes raising new senior secured debt of $10B and senior unsecured of $3B. In this LBO, they are raising multiple bridge loans in the neighborhood of $6B to retire current obligations, with $5.1B outstanding debt. Presumably, while the interest rate of existing debt is preferable to the newly raised, these 2030s will almost certainly have to be retired, as holders of this bond (most likely made up of majority institutional investors) would certainly not approve of being shoved down the cap structure, and possibly having up to $5B of the pro forma new unsecured debt share collateral with them. If this were the case, these bonds would trade down significantly. This is possibly the worst downside case – getting left holding the bonds in a much worse-off position in the new capital structure. However, it is very unlikely that the company would let these minority remaining bonds sit un-retired, as they either require bondholder approval if liens are shared, and most likely must pay off the current debt as part of the buyout according to creditor discretion anyways.

Therefore, as long as hold-outs greater than 10% of the principal occur, a make-whole should be in play. In this scenario, however, it should be noted that the company would most likely attempt to negotiate a repurchase price between the CoC at 101 and the make-whole at ~111.4, but holders could try and hold out for the MW for max upside, with the negotiating leverage that the company may likely have no choice but to retire current debt.

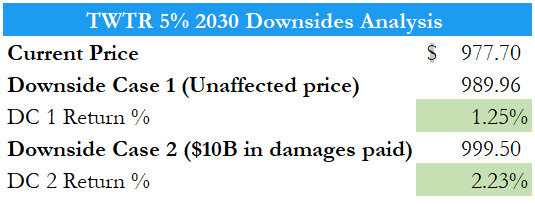

The Downside Cases1

Thus, the main downside cases are if the judge rules that the deal doesn’t close:

Twitter gets breakup fee ($1bn) – sell at unaffected price

Company comes out of the hassle with $1B more cash, minus professional fees. Assuming unaffected price on April 4th, pre-Elon news, at 98.96

Judge rules Elon has to pay Twitter damages at a higher amount – say $10B

Cash infusion of $10B would certainly cover the existing debt load, and thus the bond should trade very close to par. Will assume 99.5 for simplicity

Thesis:

Buy the 2030s with the intention of holding out for a make-whole. Depending on other creditors’ sentiment and personal risk tolerance, can also buy with the intent to take the CoC @ 101. Given that the judge has ruled for an expedited trial in which Twitter has sued for “specific performance”, which forces Musk to close the deal, all signs point to Elon being forced to close. I believe that the judge will force Elon to close, but it will ultimately execute at a lower price than the current offer of $54.20/share. This is where the main risk for buying equity in this risk arb trade is, and thus I think the bonds offer an attractive risk to reward ratio, even with a CoC. Regardless of what price Elon pays, this bond will most likely have to be retired in order to meet the lien requirements. At this point, bondholders should be able to leverage for a make-whole based on the company’s need to retire existing debt, and max profit will be realized.

Notes:

1) These downside cases are built on very simplified estimates.

More analysis should be done on whether the 90% majority will be met for the

CoC offer if the deal goes through. Even in the worst “likely” case, if Twitter

doesn’t close the deal, they still receive $1B.

a. The absolute worst downside case would be very

conditional:

i. Deal Closes

ii. You hold out on the CoC, and the company carries over your debt

to the new PF cap structure without negotiating another repurchase.

iii. Newly raised debt shares liens with your bonds. Also, new

creditors agree to share liens and carry over your debt.

b. However, this is an extremely conditional case, and highly

unlikely

c. Details such as which assets are exactly collateralized for the liens are not made public, and so I am making assumptions just to consider this as a worst case.

2) The Make-Whole case is contingent on a few conditions:

a. Being able to amass a significant portion (10%?) of the notes without

compromising your cost average in order to be able to hold out on the CoC.

i. To the extent of my analysis, I am not aware of a provision in

the credit docs that allows Twitter to execute the tender offer at CoC if a

simple majority is reached, nor am I aware of one that obliges the bondholders

to accept a change of control offer.

b. Once successfully “held-out” of the CoC, the holders have to also

hold out through negotiation that would be between the CoC and MW.

c. After this, it depends on how badly Twitter/new debt want to

retire the 2030s:

i. If Twitter wants to retire the current 2030s and not have them

carry over into the new PF capital structure

1. They have to make the MW offer/repurchase negotiate

ii. OR: If new creditors refuse to share security with the existing

debt, or don’t want them to carry over old debt

1. Twitter has to retire the debt w/ MW